In 2015, world governments convened at the United Nations Climate Change Conference (COP21) and committed to limiting global temperature rise to well below 2°C above pre-industrial levels with efforts to limit warming to 1.5°C through the Paris Agreement.

Three years later, the Intergovernmental Panel on Climate Change (IPCC) warned that global warming must not exceed 1.5°C to avoid the catastrophic impacts of climate change. To achieve this, greenhouse gas (GHG) emissions must halve by 2030 – and drop to net-zero by 2050. This is now five years back and the goal of staying below 1.5° is—even under most ambitious scenarios—almost out of reach.

Corporates around the world play a vital role in driving GHG emissions reductions and building the resilient, zero-emissions economy we need. Their action must be urgent and backed by science.

There has been a rise of various claims and pledges by corporates that all refer to climate action. The terminology used is often not linked to universally-agreed definitions, which has led to a divergence of language used to claim climate action and the actual meaning behind the claims. Common terms in the climate space these days are “climate neutrality” and “net-zero”. Both terms are being used with intent to describe corporate ambition to contribute to climate change mitigation. While there is ongoing criticism that carbon neutrality is no holistic concept and often opaque, net-zero has rapidly moved to the mainstream: in 2019, net-zero pledges covered just 16% of the global economy; by 2021, nearly 70% had committed to net-zero by 2050.

Robust net-zero pledges (associated with targets based on climate science) require an accurate carbon footprint analysis and must calculate a clear pathway for corporate climate action. While this must prioritize active emission reductions, it may also be supported by compensation of unavoidable interim and residual emissions using carbon credits.

Robust net-zero target setting: Introducing the SBTi

After the Paris Agreement came into play, more and more companies began to set climate targets to reduce their emissions. Recognizing the absence of clear guidance for setting meaningful targets alongside roadmaps for their fulfillment, the Science-Based Target initiative (SBTi) was initiated in 2015 by organizations including the carbon disclosure platform CDP, the United Nations Global Compact, World Resources Institute (WRI), and the World Wide Fund for Nature (WWF). Since then, 1,902 corporates have defined a science based target and 1,480 have committed to establishing a target.

SBTi’s Corporate Net-Zero Standard is a renowned, and the most widely used, framework for supporting corporates in setting net-zero targets aligned with climate science.

At a high-level, the requirements specified in the standard include:

- Near-term science-based targets: Emission reduction plans for 5-10 years in line with the 1.5°C goal.

- Long-term science-based targets: Most corporates are required to cut emissions by at least 90% no later than 2050.

- Beyond value chain mitigation (BVCM): Corporates are expected to take action to mitigate emissions outside their value chains.

- Neutralize residual emissions: Remaining emissions, i.e. the final 10% or less, must be neutralized with permanent carbon removal and long-term storage.

Science-based targets and negative emissions

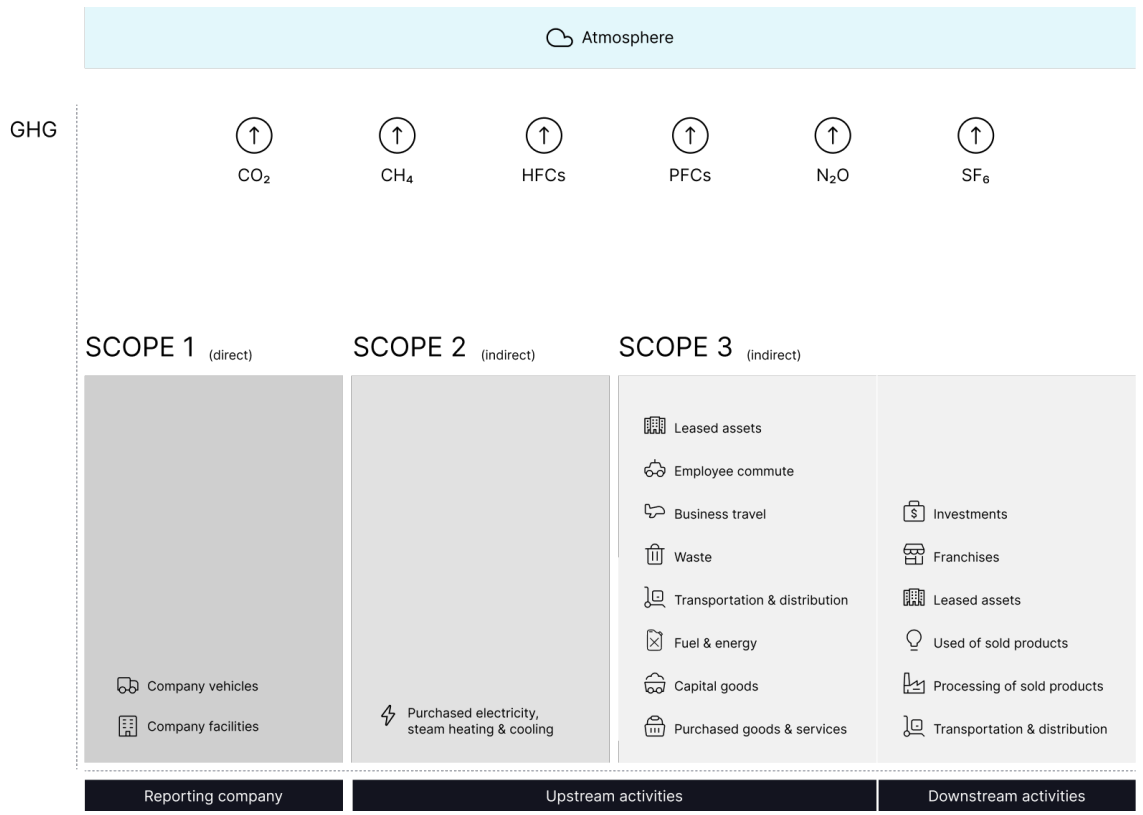

The highest priority of this standard is for corporates to set both a near- and long-term target to reduce their own value chain emissions. These include direct emissions from internal activities (Scope 1), indirect emissions associated with purchased electricity (Scope 2) and all other indirect emissions associated with upstream and downstream supply chain activities (Scope 3). The standard requires a detailed roadmap for internal carbon reduction measures necessary for corporate net-zero targets to be approved.

Additionally, the SBTi also defines the need for corporate action to tackle emissions beyond their own value chain and to actively neutralize carbon emissions that can not be internally reduced. Beyond value chain mitigation (BCVM) in this context refers to reducing external emissions, separate to a corporate’s Scope 1, 2, and 3 emissions within their operational boundaries. It can be considered a voluntary climate action, or “contribution” (a term we also see used more frequently recently), to accelerate collective global climate action.

A recent blog series clarified the SBTi’s stance on carbon credits, and announced a paper to be launched in 2023 that will provide corporates with BVCM best practices. Already, the SBTi emphasizes the importance of the following actions as means of driving global climate mitigation contributions:

- Conservation and restoration of natural climate sinks (e.g. forest, coastal and marine environments), which may be supported through the voluntary carbon market (VCM) through the purchase of high quality carbon credits

- Investment in carbon dioxide removal (CDR) technologies essential to neutralizing residual emissions, which may also be supported through the VCM, for example, through the purchase of direct air capture project credits

The new kid on the block: ISO’s net-zero guidelines

Launched in time for COP27 in Sharm el Sheikh, international standardization body ISO just published net-zero guidelines (in their language: IWA 42:2022). Based on a larger stakeholder consultation process, the framework complements SBTi’s understanding by providing clearer definitions of key terms as well as outlining required actions for corporations to achieve net-zero targets. In addition to measuring and monitoring the own GHG impact with enough depth to steer it, as well as employing a risk-based model to manage and plan mitigation, the ISO standard also sets some additional requirements that span scopes 1-3:

- Clear reduction targets are required for each sector and part of the business, including more ambitious targets for companies that are financially able to deliver those before the net-zero target date.

- Both unavoidable and historical emissions need to be counterbalanced with investment into removal or avoidance. While this can happen both within or outside the supply chain, the recommendation will practically only be scalable using VCM credits of the right quality and technologies.

- Permanence, employed technology, certification level, co-benefits, and vintage years will all need to be carefully planned into credit portfolios to match the historical or unavoidable emission profile of the company to make it work.

- Finally, counterbalancing emissions will need to factor in social and policy considerations to ensure the best possible impact both across and along the value chain.

- Companies that have the resources are also encouraged to work on becoming carbon positive, meaning counterbalancing more emissions than they account for.

While none of these requirements are surprising, the guidelines offer a good summary of current best practices with clear requirements towards voluntary carbon engagement for net-zero targets that can be operationalized with sufficient market data. In practice, the rules can be translated into clear portfolio requirements.

Harmonizing the voluntary carbon market in line with net-zero ambitions

We respect the mitigation hierarchy proposed by the SBTi. At the same time, we see that overall emissions are still increasing globally and a vast amount of emissions have already accumulated in the atmosphere. It is thus critical to intensify and accelerate climate action. By simultaneously reducing value chain emissions, mitigating emissions beyond a corporate’s value chain (through avoidance and removal credits), and compensating for currently unavoidable emissions through investments in carbon removal technologies, corporates can leverage multiple angles at the same time to increase magnitude and speed of impact.

CEEZER advocates a harmonized view of the VCM to complete robust net-zero strategies and complement in-house reduction activities. In line with the IPCC’s Sixth Assessment Report, we acknowledge different emission reduction and removal options that must be orchestrated at pace to reach global climate goals required to prevent detrimental impacts on our planet and society.

For that purpose we help our customers create impact-optimized carbon credit portfolios that match their corporate climate strategy and emissions reduction targets as well as reduce inherent portfolio risk. Furthermore, our net-zero planner helps corporates align their residual emissions and BCVM compensation activities with their individual reduction pathways while monitoring current and planning future portfolios.

To learn more about CEEZER, please get in touch or book a demo today.

References

SBTi (2022). Going Above and Beyond to Contribute to Societal Net-Zero. Available at: https://sciencebasedtargets.org/blog/going-above-and-beyond-to-contribute-to-societal-net-zero

IPCC (2022). Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [P.R. Shukla, J. Skea, R. Slade, A. Al Khourdajie, R. van Diemen, D. McCollum, M. Pathak, S. Some, P. Vyas, R. Fradera, M. Belkacemi, A. Hasija, G. Lisboa, S. Luz, J. Malley, (eds.)]. Cambridge University Press, Cambridge, UK and New York, NY, USA. doi: 10.1017/9781009157926

Emergent (2022) Understanding Corporate Climate and Nature Strategies and the Role of Tropical Forest Protection. Available at: https://emergentclimate.com/wp-content/uploads/2022/10/Emergent-white-paper-corporate-claims_.pdf