The Science-based Targets Initiative (SBTi), a central organization for climate action, enables businesses to set ambitious climate mitigation targets in line with the latest climate science. In addition to radical internal emission cuts, it also recognizes the urgent need to invest in beyond value chain mitigation (BVCM).

SBTi's definitive guidance on this topic is projected to be released later this year. Given the enormous significance of the SBTi in driving private sector action on climate change, the definition of what exactly constitutes BVCM could very well pave the way for the next wave of corporate participation in the voluntary carbon market (VCM).

A key point CEEZER advocates for in this consultation relates to what exactly is eligible for BVCM. The SBTi envisions an array of mechanisms for channeling finance into BVCM (including but not limited to carbon credits). To ensure flows of finance where it is most needed, we recommend the SBTi that companies should only count actions and investments towards their BVCM commitments if they are subject to the same additionality test as carbon credits. For climate investment via carbon credits, high-quality credits are to be selected with indicators such as additionality, permanence, and independent monitoring proven and publicly disclosed. This approach will guide companies toward implementing the most impactful climate action.

In need of strategic advice on the concepts of BVCM and neutralization? Here is how we look at the future of BVCM with leading customers in practice.

Guidance for BVCM in practice is on the horizon

Organizations across the globe are recognizing the financial and operational threat of climate change and are taking action: as of July 2023, 3,030 organizations have an approved science-based target through the SBTi and 2,197 more have committed to define a science-based target.

These organizations, accounting for more than one-third of global market capitalization, are committed to reducing their value chain emissions in line with a 1.5°C pathway. Despite this (mainly) corporate action being taken, there is still a considerable gap between what currently happens to address climate change and what needs to happen to mobilize climate finance and mitigation efforts to respect the Paris Agreement.

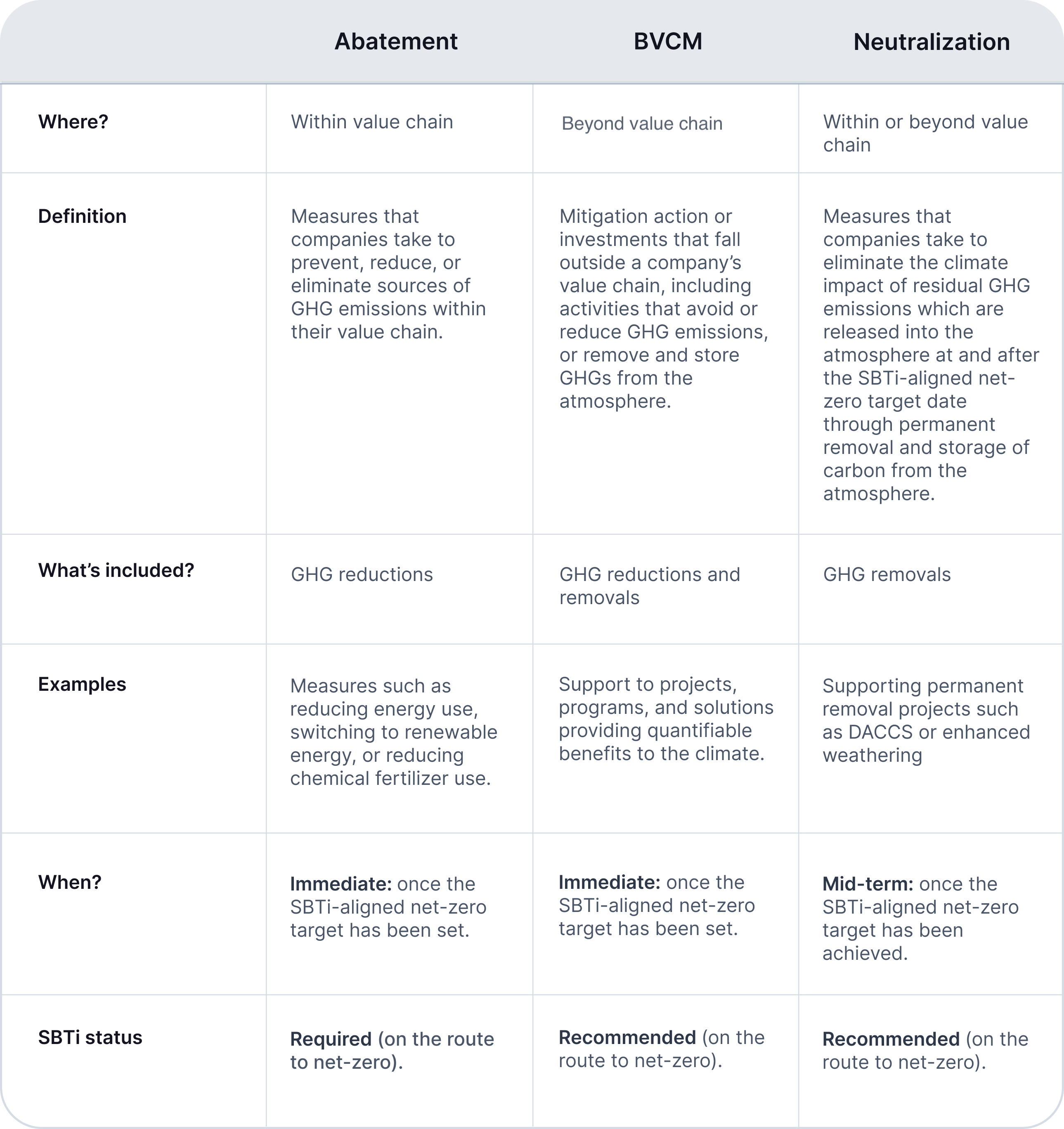

For this reason, the SBTi recommends organizations go above and beyond their within-value chain targets and invest in mitigating climate change beyond their value chains in order to contribute to societal net-zero – meaning “beyond value chain mitigation.” BVCM has been a nebulous concept so far, with a lack of clear definitions, guidelines, and processes. Essentially, it refers to interventions a company can support that reduce emissions outside of its value chain (i.e., beyond their Scope 1, 2, and 3 emissions). Simply put, it is a climate change mitigation contribution that does not count towards a company’s science-based target.

One approach is the purchase of carbon credits, which can involve both avoidance and removal. However, the concept of BVCM goes beyond this and also allows for investing in R&D or supporting lobbying and advocacy for climate policy. By supporting mitigation beyond their value chain, companies can further contribute to the global 1.5 °C target before reaching net-zero.

Recap of SBTi terminology: Abatement, BVCM & neutralization

Setting a net-zero target with SBTI means picking a date that your company will stop adding emissions to the atmosphere on a net basis. By the time your target date rolls around, you are required to have reduced emissions across your entire value chain by at least 90% compared to your baseline year. The remainder (so-called residual emissions) must be neutralized by permanent removal and storage of carbon from the atmosphere.

What exactly constitutes “permanent” removal is yet to be clarified by the SBTi. The current version of the Corporate Net-Zero Standard (April 2023) mentions both long-term approaches such as DACCS and BECCS, as well as approaches with shorter permanence such as improved soil management, improved forest management, or land restoration. For neutralization, SBTi states that “exact eligibility is to be defined in a future revision of the Standard”.

The principle at the heart of the SBTi Net-Zero Standard is the “mitigation hierarchy.” This means companies should commit to reducing value chain emissions (i.e., their Scope 1, 2, and 3) and implement strategies to achieve these commitments as their main priority before acting outside their value chains. Emission reductions must be the overarching priority for companies, and the central focus of any credible net-zero strategy.

BVCM is supposed to be the second step companies take after the abatement of value chain emissions. The sooner companies can collectively significantly reduce global emissions, the greater our chances of keeping 1.5°C within reach.

How to do BVCM and neutralization in practice

Emissions need to be reduced – there’s not much to argue about that. But what about the relationship between BVCM and neutralization? The graph below shows that BVCM efforts should begin immediately in parallel to abatement, whereas neutralization is expected to ramp up as the company gets closer to reaching its net-zero targets.

.png)

In planning a long-term carbon credit procurement strategy, the Oxford Principles provide a well-defined course of action for corporations. This entails gradually increasing the portion of carbon credits procured from carbon removal projects, with the ultimate goal of obtaining 100% of credits from permanent removal initiatives to neutralize your residual emissions in the target year.

Throughout the journey to net-zero, CEEZER advocates for an approach that balances risk and value for money in a diversified BVCM portfolio with projects of many different project types, Oxford categories, and price points. These criteria are combined based on a company’s internal selection criteria and budget. The portfolio should evolve over time, gradually increasing the share of permanent removal, until it covers at least the residual emissions at net-zero and beyond.

As explained earlier, what exactly constitutes “permanent” removal is yet to be clarified by the SBTi. Currently, carbon removal with short-lived storage (Oxford Category 4) such as soil-based or afforestation projects are eligible, but there is a likelihood that only carbon removal projects with long-lived storage (Oxford Category 5) will be allowed for neutralization in the future.

These types of credits (e.g. DACCS or enhanced weathering) are scarce and the technologies associated with them need tremendous support to be scaled up. Mature buyers already engage in early purchases and long-term offtake commitments to enable new removal methods to see the day, help existing methods to transition from pilot to full-scale deployment, and widen the playing field. For this, CEEZER partners with many exciting companies to make their projects accessible and approachable for corporates through pre-purchases and long-term offtake agreements.

Lack of guidance is holding back corporate climate action

BVCM has always been part of the Net-Zero Standard. Understandably, the lack of guidelines has prevented companies from fully embracing this approach. A recent SBTi survey shows that fear of greenwashing accusations is a significant barrier to BVCM, preventing companies from taking action and contributing further. 55% of respondents who were already purchasing credits, stated this was a barrier to them buying more. This partly lies in the lack of externally validated claims: 79% of carbon credit purchasers agree that this would motivate companies to invest more.

CEEZER works closely with buyers to support setting and executing a robust carbon credits strategy for within and beyond value chain emissions. It can be confirmed that the lack of crystal-clear guidelines on BVCM is a major hold-up for companies to engage in this mechanism throughout their journey to net-zero by investing in high-quality carbon credits.

And investment is what is urgently needed: A study by the Climate Policy Initiative estimates that annual climate finance needs to increase to at least USD 4.3 trillion per year by 2030 - a sevenfold increase from current levels. An analysis by Systemiq showed that almost 70% of surveyed companies felt that the private sector should be doing more than abatement of value chain emissions.

Steps toward convergence across the market

The VCM is fragmented, but efforts are being made by various standards and institutions to provide guidance and enhance integrity. It is crucial for market participants to have a unified understanding of the VCM, and to maintain an overview of ongoing initiatives and updates. Alerts on updates regarding governmental, legislative, or relevant SBTi framework changes are valuable tools of the CEEZER platform to keep track of this information.

Similarly, it is clear that the SBTi is not operating in isolation with its upcoming BVCM guidance. It is also part of a broader movement that aims to bring clarity and transparency to the VCM. With the recent release of Core Carbon Principles (CCPs) by the Integrity Council for the Voluntary Carbon Market (ICVCM), the publication of VCMI's Claims Code of Practice, and the forthcoming BVCM guidance from SBTi, the market may finally start to converge.

Under the VCMI’s Claims Code, carbon credits cannot be used to offset emissions, nor for making carbon neutrality claims. Instead, companies can use carbon credits to go “above and beyond” the decarbonization of activities in their own value chain to “further contribute” to cutting emissions. Instead, a VCMI Claim represents BVCM – a reference to terminology used by the SBTi.

In addition, Gold Standard has also partnered with the environmental impact platform Milkywire to support companies in implementing BVCM strategies. This initiative seeks to build upon and complement BVCM guidance by SBTi by further operationalizing it. CEEZER already partners with Milkywire and features its Climate Transformation Fund on the marketplace. Thereby, our customers can seamlessly contribute to this charitable fund through CEEZER’s portfolio planner, much like they would invest in traditional carbon credits.

Public consultation has started

The SBTi has initiated a public consultation on the topic of BVCM, which will be active from June 19 to July 30, 2023. This consultation seeks to address critical elements such as definitions, processes, and the allocation of mitigation responsibility. These aspects are complex, which is why the SBTi has assembled a team of internal and expert advisors.

The expected technical outcomes of the consultation are to:

- Further clarify the definition of BVCM

- Articulate the need for companies to go beyond their science-based targets to also invest in BVCM

- Explore the business case for BVCM

- Provide recommendations on:

- Determining a commitment to BVCM

- Deploying finance and resources across mitigation activities

- Claims, transparency, and reporting with regard to BVCM

Determining the nature and scale of commitment to BVCM

Instead of speculating about the outcome of the points above, let's focus on one specific aspect: the nature and scale of commitment. A big topic in every board room will undoubtedly be: How much and what does our company need to do here to take responsibility for our unavoidable emissions? Typically, companies have been offsetting emissions on a ton-for-ton basis (i.e., for every unabated tCO2e within their value chain, they finance one tCO2e of mitigation beyond the value chain). But this is only one of many models to determine your climate action budget.

In addition to the above approach, money-for-ton, and money-for-money approaches also exist:

.png)

Each approach outlined above has its own set of drawbacks. However, CEEZER does not endorse the money-for-money approach since it does not consider a company's carbon footprint. Thereby, it fails to align with the polluter pays principle as it does not tie to unabated emissions.

Following the consultation, SBTi will attempt to provide more guidance on “how much” BVCM a company should deliver. It already proposes that companies would follow the below steps for determining the nature and scale of their commitment to BVCM (to be further refined following the consultation process):

- Bring stakeholders together to consider the business case for BVCM based on climate change risks and opportunities.

- Weight pros and cons to select the most adequate BVCM method.

- For the chosen method, follow the steps to determine the nature and scale of the commitment to BVCM.

High-quality carbon credits enable you to take responsibility for those emissions that cannot be avoided

Companies need to take responsibility now in addressing unavoidable emissions. Purchasing high-quality carbon credits is a powerful way to kick-start BVCM efforts in parallel with abatement strategies to reach net-zero targets. For buyers, it is key to understand what high-quality means and how to handle the risk that is attached to every single credit in the world.

Planning and managing a risk- and impact-optimized carbon credit portfolio is not only a question of money and dedication but also a question of tooling. CEEZER’s proprietary algorithm selects an impact-optimized portfolio based on a given budget that is aligned with SBTi requirements, screened for quality, and minimized risk.

In the portfolio manager, a net-zero journey is mapped on a company’s current and future portfolio, constantly monitored, and planned many years ahead to counteract supply and price risk. Constant monitoring reveals quality and reputation risk instantly and helps buyers keep track of the latest governmental, legislative, or relevant SBTi framework changes.

To learn more, please get in touch or book a demo today.

.jpg)

.jpg)