Many global organizations are in full implementation mode of initiatives to meet their climate commitments. More often than not, removing and avoiding emissions outside the own supply chain is a crucial component.

A global corporate on the way to net zero

Key Objective: A listed multinational technology conglomerate had the ambition to achieve net zero in its operations (Scope 1 & 2) by 2030 in line with the SBTi pathway as well as a net zero supply chain by 2050.

The company followed a clear path to reducing its emissions and had introduced several initiatives including a complete conversion to green electricity, an electric-only company fleet as well as the adoption of low-emissions building practices.

Yet, to ensure full net zero, the company pledged to compensate unavoidable emissions of its operations across the organization by 2030. With over 300 subsidiaries in multiple regions, coordinating and steering this activity was no small feat.

300 buyers. 1 team in charge.

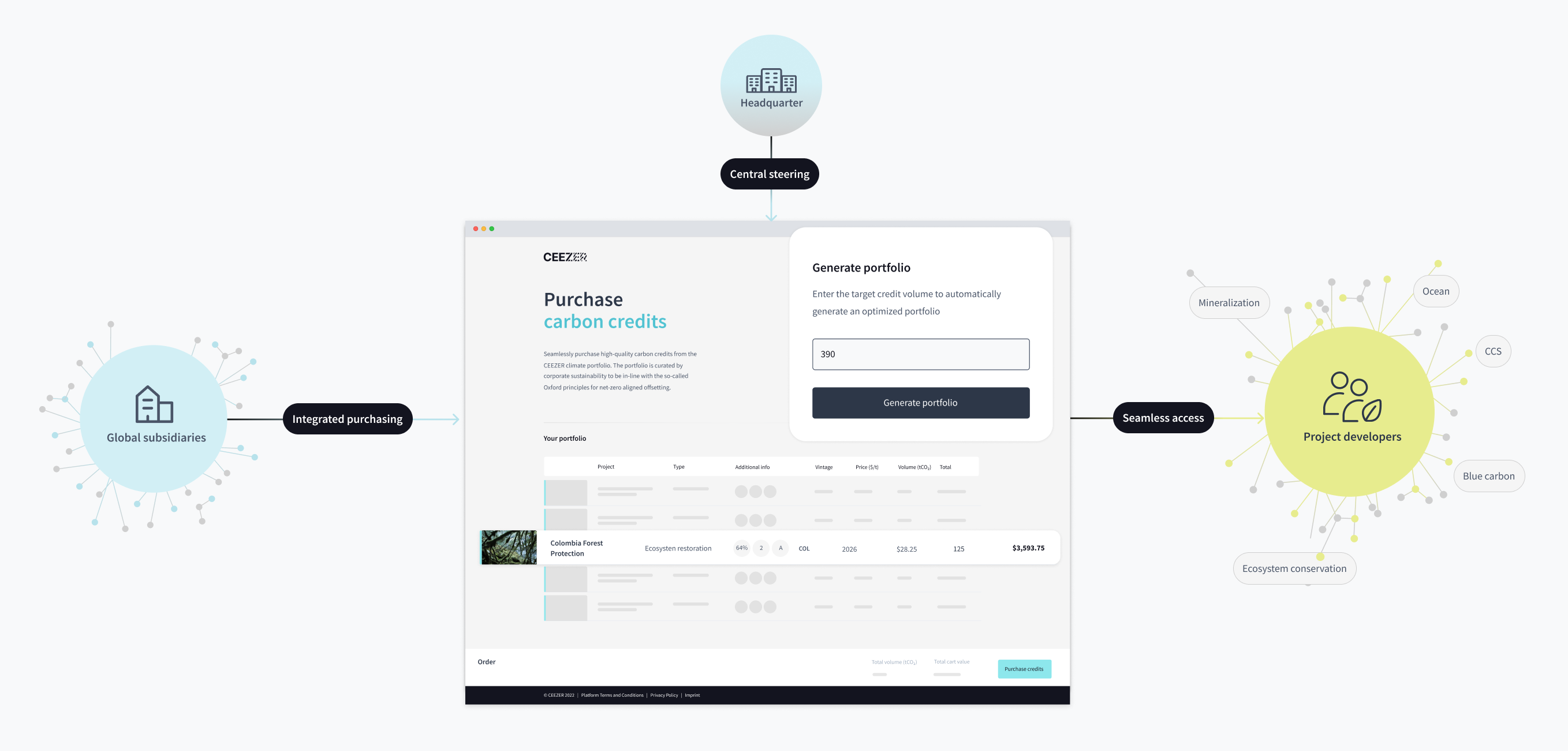

Key Challenge: Companies with complex, global organizational structures often struggle to steer quality and cost of voluntary climate action across the globe. While carbon credits work globally, purchasing power often sits at local levels which comes with a lot of steering complexity.

For the corporation, two specific challenges arose: Defining a portfolio that works globally and making sure that all subsidiaries would follow the defined criteria set.

As a global player in emission-intensive fields such as industrial goods, infrastructure, and mobility, the high emission baseline required securing substantial volumes of credits. But not only the amount needed to be managed – also the right quality. Operating across geographies and sectors required special care in selecting a fitting negative emissions portfolio due to differing regional regulations, market requirements and standards. Only via in-depth screening and full market visibility was it possible to identify not only a range of suitable credits, but also a way to flexibly adjust the portfolio over the years to come, i.e. by continuously increasing the removal share to meet net zero commitments.

In addition, hundreds of independently acting global subsidiaries made central purchasing difficult as requirements and timing needs differed significantly. The central team needed to enable the organization to take climate action on profit-center level, while setting and enforcing the global quality standard to mitigate compliance and reputational risks. Keeping central control over the selection and monitoring of carbon credits was thus crucial.

One portfolio to rule them all.

Our Solution: With CEEZER, organizations get a powerful tool to centrally select, monitor and secure the right negative emissions, while seamlessly enabling subsidiaries and suppliers to independently steer climate action in alignment with global requirements.

Based on CEEZER’s digital marketplace of >5,000 projects with comparable quality, availability and pricing data points, the central CSR team defined a portfolio of carbon credits based on an objective set of measurable criteria. These criteria would then be leveraged to flexibly add newly available projects to the portfolio in case of increased volume requirements. The resulting portfolio set-up ensured that crucial requirements such as volume needs, budget constraints and quality levels were ensured and measurable.

Integrating CEEZER into the existing SAP-based purchasing workflow then enabled all global subsidiaries to independently procure eligible credits. Managers with access to the integrated tool were catered a curated view of already approved projects and could buy negative emissions with one click. Transaction handling and approval processes were managed automatically by CEEZER within the native SAP purchasing flow.

As a result, subsidiaries were able take immediate climate action without incurring any risk of breaching the global quality requirements. At the same time, the compensation path towards net zero could be centrally steered by the CSR team with all transaction and volume data available at any point in time. Reports and analytics on the portfolio composition (e.g., share of removal, permanence, risks) were continuously available to the central CSR team, allowing them to actively manage the net-zero path.